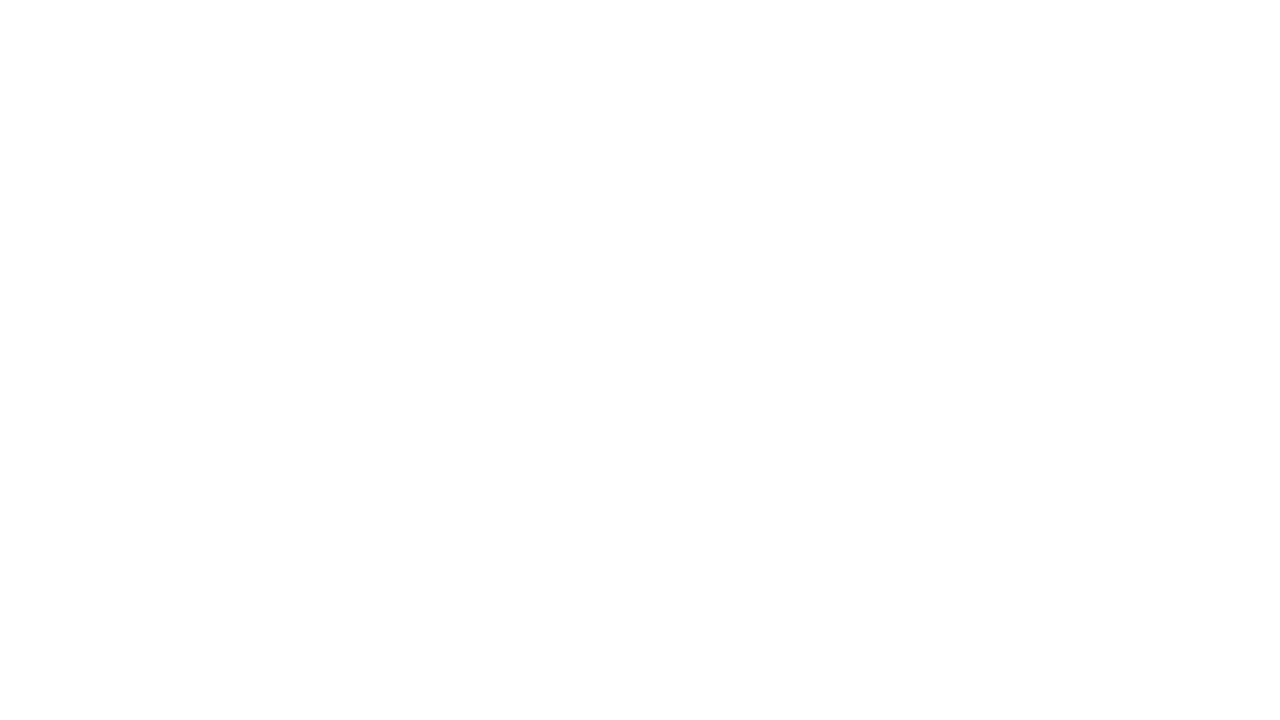

The Government of India introduced a new optional tax rate regime starting from April 1, 2020 (FY 2020-21). The new tax regime has widened the scope of taxation with seven tax slabs rates ranging from 0% to 30% with the highest tax rate applicable on income above INR 15 lakh.

While there were only four tax slabs in the old regime from 0% to 30% with the maximum rate applicable on income above INR 10 lakh.

There won’t be any benefits due to investments in tax saving instruments, Like - paying premiums on life or a medical insurance policy, children’s school fee, home loan principal repayment, etc., as well as for HRA, LTA, etc. in the new tax regime.

Here is the tax slabs of new and old tax regime

Comparison: New Vs Old

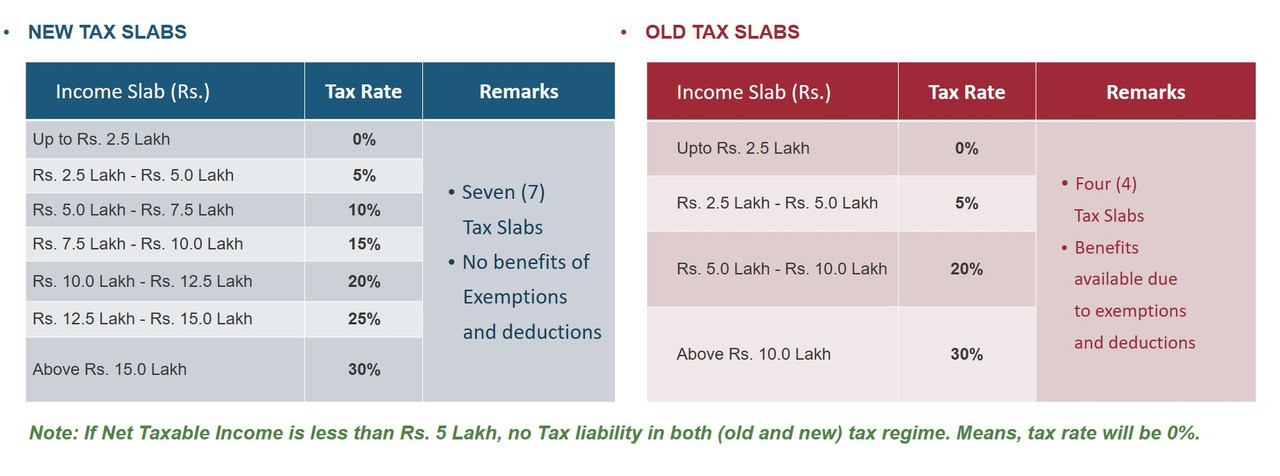

A. Considering 1.5 Lakh Deductions under 80C

A standard deduction of 50k is applicable for almost all employees. So, I am freezing this amount and changing the other deduction for the old tax regime. Generally, many of us take advantage of maximum deduction (1.5 Lacs) under 80C. Following is the percentage of tax amount wrt different Gross Income.

- As we can see, Old Tax Regime is good for lower-income and New Tax Regime is good for higher income.

- There is a break-even point at Gross Income: 12.25 Lakh, where New and Old Tax has equal tax share.

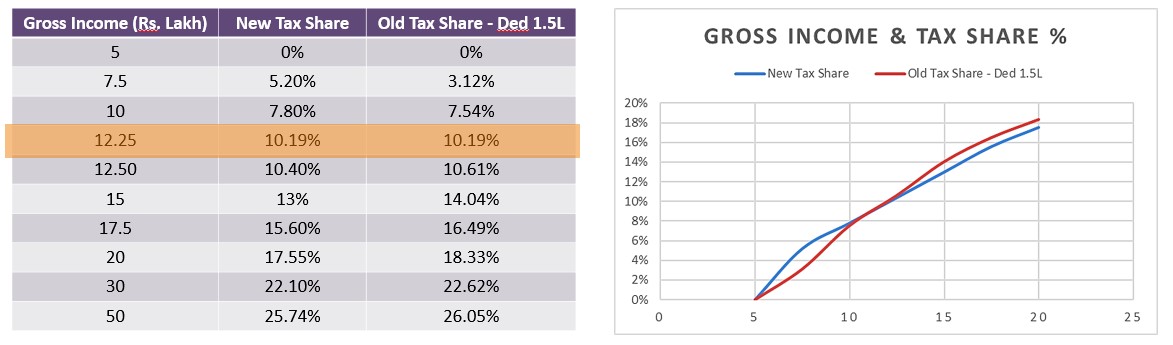

B. Considering 10 Lakh Income

- As we can see, Old Tax Regime is good for higher deductions and New Tax Regime does not depend on deductions.

- There is a break-even point at deduction of: 1.37 Lakh, where New and Old Tax has equal tax share. Considering 0 lakh gross income

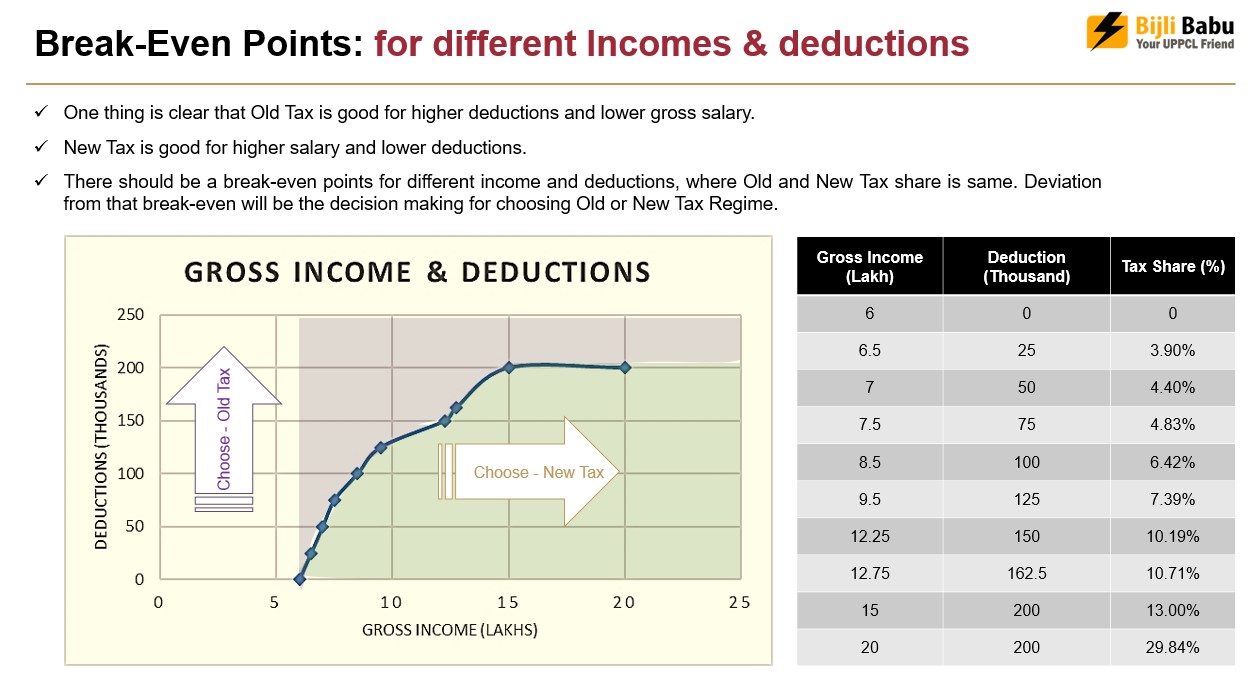

Break-even points

Combination of Gross income and deductions where new and old tax structure is having same tax. This will give us an idea of which area of the following graph is beneficial for the new tax structure and which area is for the old tax structure.

Download

Download the excel sheet to calculate the new and old tax to compare them: https://bijlibabu.com/bb_library_details.php?id=82

YouTube Video

Uttar Pradesh Power Corporation Limited is ready to provide the new electricity connection within 10 days. Yes, applicants may apply a new e...

We are all surrounded by electrical products in our day to day lives. it could be phone chargers, extension cables or power outlets All this...

Analyze the pattern of a postpaid electricity bill. It is generated after one month's consumption. it is having 14 days due date period and ...